The festive season is certainly upon us, reaching the halfway mark of the Golden Quarter this week. After two years of uncertainty, expected to continue into 2023, this year’s peak trade season could be the making and breaking of some retail brands.

Having not had a ‘normal’ year of trade since 2019, it would be fair to say there isn’t a norm for peak trade anymore since the world has changed so much, so have our lifestyles, habits and needs and there isn’t really any consistent data to back it up. So what’s happened in the Golden Quarter already? And how does this set up the rest of the peak season as we head into the most crucial events?

The Amazon Prime sale is usually a precursor for Amazon’s Black Friday sale. This year, Amazon released an ‘Early Access Sale’ for prime members with two days of sitewide pre-Christmas offers and discounts in October. Falling six weeks before Christmas, the event marks an earlier start to Peak Trade.

Amazon commented; “It’s not too early to start planning your shopping for the festive season ahead, and this exclusive 48-hour sales event will help people save money and shop smarter as we head into the festive season.”

Positioned around offering discounts earlier to help consumers manage the cost of Christmas, the early sale helps Amazon to collect data early on to see how spending patterns are changing, and determine how to adapt prices, product ranges. This helps to flatten the peak in demand, lowering impact on supply chains whilst ensuring they don’t have excess stock at the end of the season.

High-street brands have also followed the same suit as Amazon this year, ordering stock earlier this year to help customers who are planning to spread costs. Typically, Christmas products would be launched gradually through the end of September and October however this year some brands brought out their entire Christmas ranges from mid-September to help consumers that want to shop early. This too is expected to bring peak trade forward by around 4-weeks, flattening the curve.

Amid increasing costs and supply chain pressures, this year delivery could be an issue. A long summer of strike action is set to continue into the winter with Royal Mail having planned strikes on Black Friday and the week following Cyber Monday.

It is expected that strike action will cause delay far greater than the strike period itself, impacting consumer confidence that their Christmas orders will arrive in time. This has helped drive some of the early ordering we’ve seen but has the potential to also drive high-street footfall as customers ensure take autonomy by shopping in-store or using click and collect services.

With retailers fighting a mix of strike action and rising operating costs on top of stressed supply-chains, their profit margins are increasingly tight and therefore some may be looking to pass on costs to the consumer through delivery and returns options, further encouraging consumers to shop in-store.

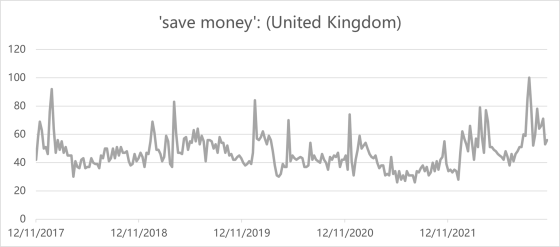

Most consumers have already decided how they’re going to spread the cost of Christmas and make their best effort to save on spend. With almost 60% of British shoppers expected to cut back this season as the cost-of-living crisis bites, Google Trends show that search enquiries for the topic ‘save money’ have increased to a five-year high with search interest peaking at 100 in September/October 2022.

Whilst the stats look scary, people are still looking to have a good Christmas however, they will, and have been already, far more considerate in their purchases. Retailers are helping their consumers by offering a broad range of payment options, like the Very Group, or suspending click and collect charges and extending exchanges and returns periods like John Lewis have.

The first half of the Golden Quarter has seen every retailer do their best to manage supply chains and increasing costs in order to not pass them onto the consumer and make sure Christmas shopping is delivered and on-time amid a consistent uphill battle. It’s expected we’ll see this right through the peak trade season with the winners being the retailers that look out for their consumer.

We think you might like these posts too

© 2025 Retail Assist Limited. The Hub Floor 5A, 40 Friar Lane, Nottingham, NG1 6DQ.

Registered in England. Company number: 03790674

info@retail-assist.com | +44 (0)115 904 2777

Website Designed & Built by we are CODA